Income & Medicare Premiums

IRMAA -for Medicare Beneficaries Medicare does not cost the same for everyone, and some individuals are subject to pay higher premiums due to their income.

Knowledge Is Power

Knowing your timeline to either enroll or defer Medicare is extremely important. Taking advantage of your Initial Enrollment Period (when turning 65) is pertinent to ensure you are not paying higher cost for your medical insurance.

There is no limit on out of pocket costs with Original Medicare. Neither Medicare Part A or Medicare Part B offer 100% coverage for hospitalization or medical services.

Choosing your plan based off of premium amounts could cause you to have higher costs with your services. Each plan comes with a booklet of information and it is important that you are reviewing the Evidence of Coverage and not just their plan highlights.

Open Enrollment is every calendar year from October 15th through December 7th. During this time, insurance companies can change their premiums, networks, and copay amounts. Be sure to review your plan so you know how these changes can affect you for the following year.

Medicare is not automatic for everyone and signing up just because you are 65 is not always best. There are multiple times of the year when Medicare allows you to enroll without being subject to penalties.

Not electing a Part D drug plan when initially eligible can make you face a penalty that grows more every year you go without.

Medicare is completely individualized. You must break away from doing everything as a family policy. What policy your spouse goes with does not mean the best for yourself.

Every carrier has a different network and formulary. It is crucial that you enroll into a plan that covers all your doctors/facilities, as well as prescription drugs.

Policies are like not like clothes. One size does not fit all. What works for your friend, might not be best for you.

Did you know that working with us is at no cost to you? Call today to get the help you have been longing to receive. We are not biased to any carrier over the other. We are shopping specifically for you and work as your advocate along the way.

IRMAA -for Medicare Beneficaries Medicare does not cost the same for everyone, and some individuals are subject to pay higher premiums due to their income.

Medicare Part D & the Donut Hole Medicare Part D may seem simple at the surface, but it can create surprises for some Medicare beneficiaries. There

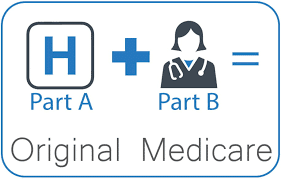

What does Original Medicare Cover? Medicare can seem daunting at times and if you are approaching your 65th birthday, it can feel like you have a

Medicare & HSA You made it! It may seem surreal that Medicare is finally approaching your doorstep and the discussions around the water cooler about

Enrollment Periods with Medicare Medicare is not automatic for everyone; signing up just because you are 65 is not always the best strategy. We will

Enrolling into Medicare & Social Security at the same time When it comes to taking retirement benefits from Social Security and Medicare, it may not

When it comes to Medicare in Minnesota, there are over 400 plan combinations that an individual can have. Choices are great but shopping for coverage

Why do I need to purchase insurance with Original Medicare? Medicare does not cover all your medical needs at 100% and does not have a

What should I consider when reviewing Medicare plans? Understanding the complexities of Medicare can be daunting and knowing when to start planning is crucial to

How to Sign Up for Medicare Signing up for Medicare is not the same process for everyone and acting at the right time for your